Unbundling Sotheby’s

DeFi’s arch of innovation, historically speaking, has been focused on introducing new financial primitives, like AMMs and perpetuals, that give users new ways to trade cryptoassets. As of today, the land grab for obvious primitives has mostly ended, leaving only smaller exotic primitives to explore. The next wave of innovation will focus on using DeFi rails to fix broken markets.

There is a common pattern of market development. New markets tend to start as opaque, dark, OTC-traded markets (including BTC). This is natural, as a new market is by definition, new. It takes time to establish an orderly market structure with an order book, market makers, clearing houses, custodians, etc. Over time, markets naturally mature and evolve to centrally-managed, transparent, lit marketplaces. This has been observed across many commodity markets, but it is now starting to happen at an accelerated pace in the luxury goods space.

History doesn’t repeat, but it rhymes. Below is Andrew Parker’s infamous “The Spawn of Craigslist” graphic depicting how several early, VC-backed Internet companies spun out of Craigslist categories.

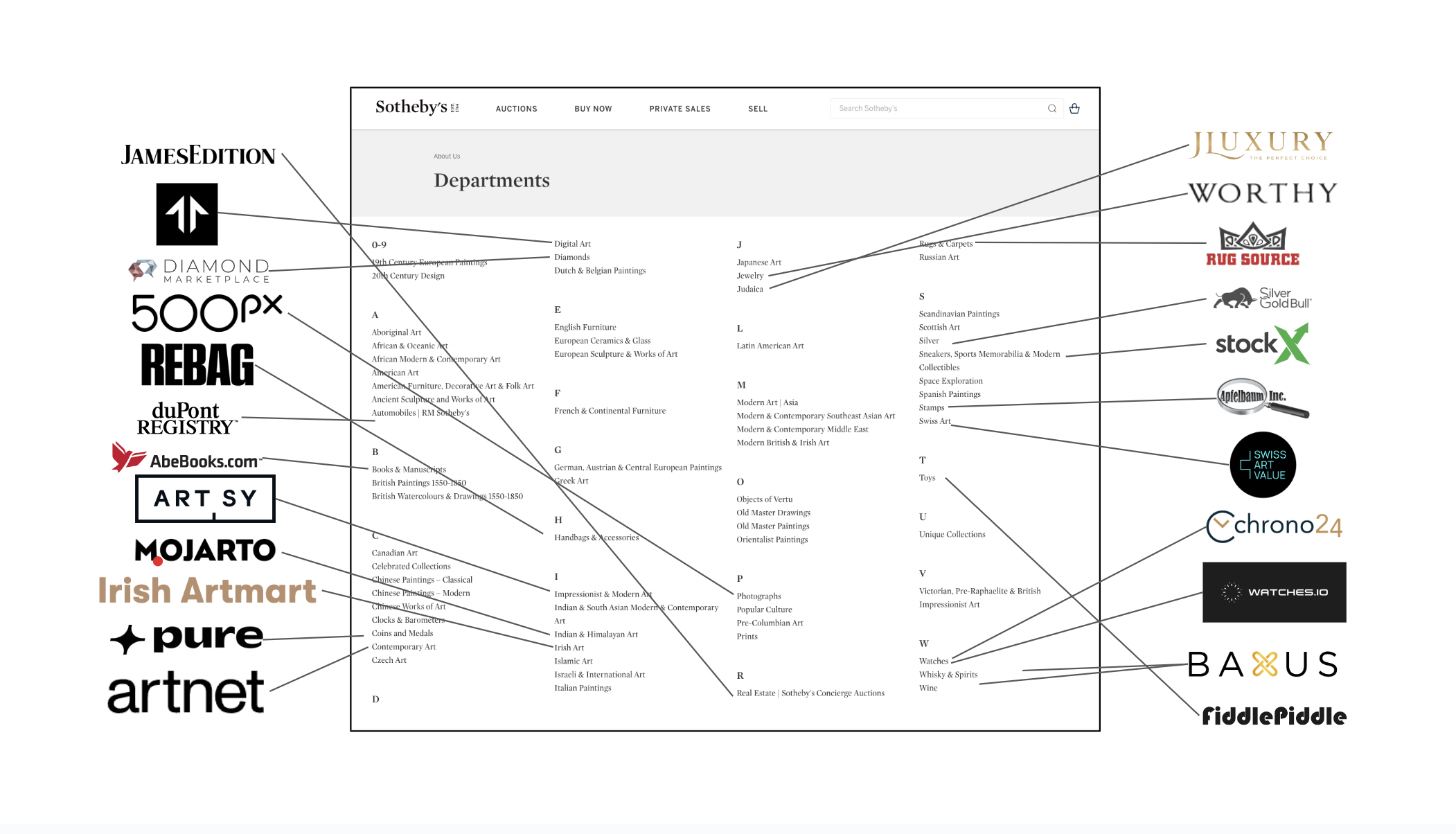

We are now witnessing a similar trend that we call “The Unbundling of Sotheby’s.” Online marketplaces are redefining and expanding previously illiquid markets in the luxury goods space, accelerating growth and transparency, and in the process increasing liquidity.

As my partner Kyle previously wrote: “Almost every sub vertical on Craigslist has become a large enough market with enough idiosyncrasies to justify a bespoke marketplace with dedicated features and optimized search and discovery.”

The Unbundling of Sotheby’s

We know from Sotheby’s financial reports (prior to the company going private) that online sales were growing at an increasing pace. From their 2018 report: “In 2018, online sales increased 24% to $220.4 million and include $72.1 million of sales attributable to online-only auctions and sales through Sotheby’s Home and Sotheby's Wine, as compared to $18.9 million in the prior year. Online sales are an important source of client growth and opportunity, with 60% of first-time bidders at Sotheby's coming through digital channels.”

Additionally, Sotheby’s own article says, “Research by ArtTactic shows that in 2018 online-only sales at Sotheby’s, Christie’s and Phillips accounted for just $116m; by 2022, this had grown to just under $900m.”

As ecommerce takes an increasingly larger share of luxury goods, buyers and sellers are going to want to use platforms that have sector specific focus. These platforms will do a better job of aggregating qualified buyers and sellers, developing more accurate price data, and fine tuning discovery and curation.

Teams building focused marketplaces also have the privilege of dedicating more time to building relationships with primary market participants (Nike for sneakers, Macallan for whiskey, Rolex for watches, etc), and partnering with them as lead generation and customer engagement—on “exclusive drops,” as an example. Primary market issuers of these assets want their products to be liquid on the secondary market, and are incentivized to help dedicated marketplaces be successful. They are also more likely to work with companies that are focused exclusively on their products’ category (why would a luxury watch company send customers to a marketplace that also facilitates sneaker trading? Unless explicitly cross-marketing, why even suggest buying something from a different “asset class?”).

The best example of "The Unbundling of Sotheby’s” is probably StockX, which got off the ground by authenticating sneakers and creating a lit market for sneakers to trade. When StockX launched in 2016, secondary market volume of sneakers globally was $1B/year. It’s now $11.5B, and StockX alone is mostly credited with accelerating the growth of the market; they showed the world what’s possible when you introduce authentication and P2P trading to high-end assets through a trusted brand.

Another great example of a successful unbundling is Professional Sports Authenticator (PSA), which started as a verification service for high-end sports cards, and has since expanded to offer custody and trading. They later acquired Card Ladder, which is the leading provider of historical pricing for sports cards.

In the luxury space, pricing accuracy, authentication, and brand trust are paramount. The reason StockX and PSA have such powerful flywheels is not only the verification and the trust that comes along with it, but also that they are the canonical provider for secondary market sneaker and sports card prices. Companies building in this arena can become the most trusted, de facto marketplace by bundling verification, trading, custody, and, importantly, a “price oracle.”

BAXUS for Collectible Spirits

Today, I’m excited to announce that we led a $5M seed round in BAXUS, the global marketplace for collectible spirits. They are immediately addressing the massive, $85B/year whiskey market— a dark, highly-inefficient market. Solana Ventures, Narwhal Ventures, FJ Labs, and prominent angels also participated in the financing.

BAXUS is building a blockchain-enabled, StockX-style market for collectible wine and spirits. The market for trading high-end wine and spirits is quite fragmented. Today, most of the market exists on far ends of the same spectrum, either in P2P exchanges via Facebook Groups or in high-end auction houses, like Sotheby’s.

Another one of the biggest challenges beyond discovery and trading is how to actually transport the bottles. Todd Wiesel, BAXUS’s founder, previously ran whiskey trading at Dalkeith Brokerage, one of the largest whiskey trading firms globally. What he noticed is that clients were surprisingly comfortable taking on custody risk—meaning they actually preferred someone to custody the bottles and casks for them—so they could more easily trade with counterparties in a faster and more efficient way.

Colossal Dark Markets

Over the last two decades, whiskey as an asset class has significantly appreciated in value, particularly Scotch, Bourbon, and Japanese whiskies. The Knight Frank Luxury Investment Index named Scotch whiskey as the best-performing asset class between 2011 and 2021, with an appreciation of 428% among "luxury collectibles."

The average price of a bottle of Scotch whiskey in the secondary market rebounded to a new record of $588 in 2021. The Apex 1000, an index of the top 1000 Scotch whiskey expressions, has appreciated >400% since tracking started in 2012. Here’s Bordeaux Index data:

Per Decanter.com, the biggest challenges in the whisky market are: “low levels of liquidity in the market and varying prices for individual bottles at auction to the importance of buying from reputable sources – given general concerns about possible counterfeits.”

In sum, today there is no de facto whiskey marketplace that bundles discovery, trading, custody, authentication, pricing, and transport. There are large gaps in pricing data because Sotheby’s/Christie’s/Bonham’s hold limited auctions. Additionally, if you purchase a bottle at a Sotheby’s auction, buyers will most likely be surprised by the hidden fees that accompany every purchase. As a result, buyers in the high-end market often significantly overpay the real market price. I recently attended a Sotheby’s auction in NYC and purchased a bottle of whiskey, and ended up paying 36% (!) over paddle sticker price.

On the other end of the spectrum, if you’re buying via a Facebook Group, there’s virtually no protection against fraud or counterfeit bottles. It’s also a regulatory gray area, because most likely neither participant holds a liquor license.

Lighting Up Collectible Spirits

BAXUS is a vertically integrated marketplace that facilitates global trading of tokenized rare wine and spirits in a regulatory compliant way. The platform enables users to transport their collection to a BAXUS facility where each bottle is scanned and authenticated, and stored in a temperature-controlled, insured vault. They also use Helium’s IOT network to enable real-time updates on the status of each bottle, from location to climate conditions, ensuring that vault humidity and temperature are perfect for the bottles. Over time, they want to expand the vault network globally to improve logistics and match incoming user demand. As of today, there are $47M of assets custodied in BAXUS vaults.

BAXUS tags each bottle with an RFID and mints a Solana NFT, creating a permanent record of authenticity (until it leaves the vault). Users can buy and sell bottles via “NFT trading,” use them as loan collateral (right now these are purely structured deals, rather than pool-based DeFi borrow/lend), or redeem whenever they want and have the bottle shipped to them. All of this, and the crypto exchange and payment rails, is wonderfully abstracted away for everyday, non-technical collectors.

Additionally, BAXUS recently acquired BoozApp, a mobile app that allows users to virtually track their collection, including prices, tasting notes, fill levels, etc. BoozApp currently tracks over 1.5 million bottles and has over $100M of collective value on the app—it’s one of the most popular apps among spirits collectors. The BAXUS team is planning to integrate the market data from BoozApp into BAXUS, and use that to enhance their market and pricing data.

Over time, the BAXUS team can use crypto incentives to reward users who report their collections on BoozApp and scan bottles in stores. This is a real world instantiation of Multicoin’s DataDAO thesis that we’ve held for a long time now.

When users add bottles to their collections on BoozApp and BAXUS, the team can work directly with primary issuers (distilleries and wineries) to help them market to their existing consumers. In the current version of the world, there’s virtually no direct relationship on the whiskey side between distilleries and collectors who consume their bottles. More and more spirits brands are releasing high priced bottles specifically to cater to the collector / investor community, and they are going to want to build direct relationships with their collectors rather than just hoping the bottles eventually end up in their hands. BAXUS is going to step in and fill this gap.

Cheers!

In our many conversations with Todd, we’ve been blown away with his focus and vision clarity. In addition to Heading Old & Rare Bottles for Dalkeith Brokerage, he has consulted for numerous spirits and RTD brands with a primary focus on Independent Bottlers, as well as overseeing the global launch of DS Tayman, an independent bottler of Scottish single-malt whiskey.

When investing at the intersection of web2 and web3, the gold standard for us is a team that has a combination of 1) a deep understanding of the market they’re operating in (high-end spirits in BAXUS’s case), and 2) deep crypto roots and willingness to engage with the broader crypto ecosystem.

The BAXUS team has shown this ability at the intersection in spades, and we could not be more excited to partner with Todd, Carrie, and Finian as they reshape the spirits industry.

p.s. If you are a whiskey collector, feel free to ping me at [email protected], or even better reach out to the BAXUS team directly at [email protected].

Thanks to JR on our team for all of the conversations that inspired this post and thesis, and for reviewing it and adding valuable feedback.

Related News

© 2025 DeFi.io